May 30

Getting Personal with Healthy and Not-So-Healthy Employees

by Steve Suter

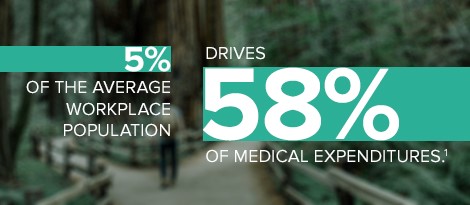

For healthcare plans, there are (very broadly speaking) two kinds of members: healthy and not so healthy. Typically, healthy members are folks who proactively address their healthcare needs and stay healthy by accessing preventative care services, exercising, and eating well. Conversely, the not-so-healthy crowd accesses healthcare only when a catastrophic event takes place. This high-risk, not-so-healthy group drives a disproportionate share of the medical costs. According to Verisk Health Analytics, 5 percent of the average workplace population drives 58 percent of medical expenditures.1

Admittedly, there are some catastrophic health situations that can’t be avoided. Even the most thoughtful and self-aware person can be suddenly and unexpectedly thrown a curveball with a devastating new cancer diagnosis or a disabling disease. Not-so-healthy members are often possibly not so healthy because of social determinates such as the ability to pay for and access fresh food, limited transportation options to easily seek care, or the burdens of multiple jobs, which makes accessing a primary care provider during office hours difficult.

Regardless of the kind of member, there are strategies that can be employed to help manage known or unknown life events. Care can be managed more efficiently with an additional layer of focused care navigation embedded within a healthcare plan. Care navigation stretches beyond standard utilization management and case management services to help many health occurrences be managed more effectively.

Often, the human touch in care delivery is lost in traditional, large-scale healthcare insurance plans. These plans are often difficult for members to work with, where services are often impersonal and fragmented with some portions of the operation even being outsourced. That’s not very personal.

Opportunities abound.

The concept of care navigation (as we approach it at HMA) is centered on a philosophy of personal outreach to members. Personalized outreach to members opens a world of opportunities not only to drive to better health but also to realize significant cost savings for employers.

HMA’s Care Navigator outreach is focused toward members that are identified as high risk prospectively (before their costs start to significantly escalate). Members that are frequent utilizers of services can also be identified retrospectively through claims history analysis. This provides the opportunity for guidance in future care needs. Once the Care Navigator has identified a member, a purposeful outreach can be initiated to help identify patterns that may cause that member to seek services.

Offer high-value outreach.

HMA’s Care Navigator program connects with members in each of these demographics both prospectively and retrospectively through personal, white-glove outreach and benefit awareness campaigns. Client-specific data reveals where individual opportunities exist so that navigators can provide personalized outreach to help members when they need it most. Utilizing industry-leading predictive analytics, we proactively reach out to members that are at high risk or about to embark on a course of care. Our HMA Care Navigators connect directly with members to understand their current health status, check on their preventive care, and provide education about what could be difficult and costly courses of care.

The Care Navigator program is already showing an industry-high level of true member engagement with successful outreach calls at 77 percent. (Typically, similar programs in the industry are able to engage with about 5 percent of the target population.) We’ve also seen our program drive claims cost savings year over year and afford many cost avoidance opportunities. Personalized guidance and data-driven, targeted outreach generate higher awareness of plan benefits, more informed healthcare choices by members, and a more proactive approach to personal healthcare that can address health issues before they become a catastrophic diagnosis. Because of this, we see higher member satisfaction as well as significant cost savings for employers. At HMA, we are driving healthier futures at lower costs.

Care Navigator: Engage, Guide, Enhance.

To learn more about Care Navigator from HMA, contact our sales team.

Disclaimer: The information contained herein is not intended to be legal advice, and while every effort has been made to ensure that the content of this summary is accurate, we make no representations or warranties in relation to the information provided, and we assume no liability or responsibility for any acts or omissions based on this information. As always, we encourage you to consult with your own legal counsel prior to making any decisions regarding plan design or administration.

[Footnote]

1. Ron Leopold, “Using Data to Drive Down Health Care Costs,” Willis Towers Watson Wire blog, September 16, 2015, http://blog.willis.com/2015/09/using-data-to-drive-down-health-care-costs/.